Auditor General Highlights Government Financial Manipulation Risk

A new report to the legislature in Victoria from Auditor General Michael Pickup identifies key areas of concern after his office’s audit of British Columbia’s financial statements for the 2021-2022 fiscal year.

British Columbia’s Finance Minister, the Honourable Selina Robinson released the Summary Financial Statements consolidating the financial results of over 160 public entities in August.

Pickup’s report found that Robinson’s financial statements are fairly represented except for three material misstatements that fall outside of public sector accounting standards. As well, the report highlighted severe instances of fraud in relation to Covid-19 program expenditures.

The misleading errors or omissions include:

The Province’s accounting of funds from other governments, and for externally restricted funds received from non-government sources.

Incomplete disclosures of future contractual obligations.

Its accounting of a revenue-sharing agreement between the BC Lotteries Corporation and B.C. First Nations.

“The B.C. government is obscuring its financial position by applying an accounting policy designed to smooth earnings out over long periods of time,” Pickup said.

“Our concern is that this opens government accounting up to possible future financial statement manipulation. It also hinders financial statement users, such as MLAs, from engaging in healthy, informed debate about government's finances.”

Deferral of Revenues Debate

Over the last 11 years, four separate auditor generals have identified a significant misstatement in the financial statements that the B.C. government continues to be at odds with.

When receiving funding contributions from outside sources, such as the federal government, the province applies these as deferred revenue, as opposed to revenue.

If Robinson would adhere to generally accepted accounting principles (GAAP), this would add nearly $6.5 billion to the province’s surplus for the 2021-2022 fiscal year.

One, why is the province not adhering to accounting principles as outlined and enforced by the federal government when receiving funds from the federal government?

And two, it is entirely possible that the province wishes to not recognize $6.5 billion in revenue for the 2021-2022 fiscal year as it would be recognized as a surplus and future funding may be cut.

The Finance Ministry has defended its accounting, saying the reported revenue accurately reflects grants that cover multiple years, rather than appearing as a lump sum.

Insufficient Disclosure of Contractual Obligations

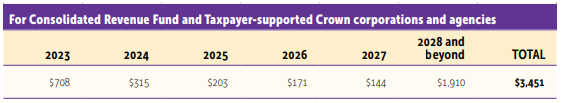

The report found that the province did not disclose over $3.4 billion of contractual obligations in their Contingent Liabilities and Contractual Obligations note to the Summary Financial Statements.

Contracts below $50 million were not added to the totals, which means that the total effect of these omitted contract amounts represents a material misstatement in Robinson’s financial statements.

Because these obligations are contingent on the government making certain expenditures, for a considerable period into the future, they must be disclosed. Not doing so goes against public accounting standards.

BC First Nations Gaming Revenue Sharing and Financial Agreement

The Gaming Control Act (section 14.3) states:

For each fiscal year beginning on or after April 1, 2021, the lottery corporation must pay to the partnership, by paying to the government on behalf of the partnership, 7 per cent of the actual net income of the lottery corporation for the fiscal year.

The act ensures that 7% of the annual net income of the British Columbia Lottery Corporation must be paid to B.C. First Nations Gaming Revenue Sharing LP.

Robinson’s financial statements do not include gaming revenues earned by the lottery corporation. As a result, revenues and expenses were understated by $91 million in the Statement of Operations. To add, payments under this act represent a contractual obligation that should be included in the contingent liabilities and contractual obligations disclosure note.

Exorbitant Price Tag of Weather-Related Disasters

Since 2002, B.C. has had 24 significant floods, landslides and wildfires, while nine of them occurred in the last six years.

In 2021, the province was hit with three significant weather-related disasters, most notably the atmospheric river disaster that occurred in the Fraser Valley in November 2021.

Response and recovery costs from the atmospheric river disaster were estimated to be $3.5 billion, which is more than the entire cost for all weather-related disasters in the past 20 years.

Because of the inordinate price tag for these natural disasters, it is vital for the province to ensure that emergency resources are managed efficiently.

Increased Risk of Fraud In COVID Relief Funds

The purpose of the B.C. Emergency Benefit for Workers was to provide one-time, tax-free, $1,000 payments to eligible B.C. residents whose ability to work was affected by COVID-19. The program ended up paying benefits of $643 million to 643,000 applicants.

To be eligible for the benefit, applicants had to meet eligibility criteria, specifically a submission of a 2019 B.C. tax return. The Ministry of Finance identified 45,000 files (7% of applicants) that did not appear to file 2019 taxes.

As of June 30, 2022, the ministry had reviewed 11,014 files and reported that 95% of them were ineligible for the benefit, totalling $10.5 million.

There were fewer instances of fraud in regard to the B.C. Recovery Benefit for Families and Individuals as eligibility was verified prior to payment, drastically reducing any risks associated.

The Ministry of Finance is authorized under legislation to continue auditing files through December 2023.

(Top photo of British Columbia Auditor General, Michael Pickup via Andrew Vaughan/The Canadian Press).