Despite Looming Recession, Half of Canadian Workers Plan To Find New Job in 2023

In a month where we saw the Bank of Canada, Federal Reserve, European Central Bank and the Bank of England all raise their policy interest rate by 50 basis points, furthering the likelihood of a recession, many Canadian workers will be seeking new employment in the first half of 2023.

According to a survey conducted by talent solutions and business consulting firm Robert Half, half of professionals in Canada are currently looking or planning to look for a new role within the first six months of 2023, up from 31% only six months ago.

Job search plans. (Source: CNW Group / Robert Half Canada).

Broken down by generation, those most likely to make a career move in early 2023 are as follows:

Gen Z and Millennials (56%)

Technology professionals (57%)

Employees who have been with their company for two to four years (61%)

Working parents (55%)

"Many Canadian workers continue to have confidence in the job market despite news of layoffs and a slowdown in hiring," said David King, Senior Managing Director, Robert Half, Canada and South America.

King elaborated that "professionals with in-demand skills know they have leverage given the talent shortage, and are open to new opportunities that offer more fulfilling work, a higher salary, and improved perks and benefits."

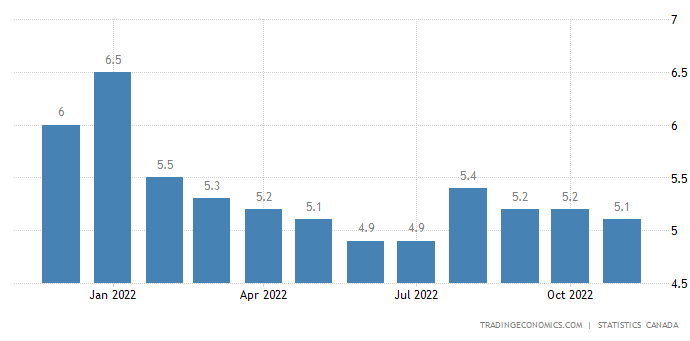

On December 2, Statistics Canada released its monthly labour force characteristics, showing that Canada’s unemployment rate dropped from 5.2% to 5.1%. However, promising numbers were not identical across every province.

British Columbia saw a rise in its unemployment rate from 4.2% to 4.4%, primarily due to job losses in the construction sector.

Canada’s unemployment rate for the trailing twelve months as of November, 2022. (Source: tradingeconomics.com).

What is driving Canadian workers to change roles is primarily a higher salary. The survey listed the main reasons as follows:

A higher salary (62%)

Better benefits and perks (39%)

Better advancement opportunities (30%)

Greater flexibility to choose when and where they work (27%)

Returning to a previous employer is also a possibility with four in ten professionals willing to go back to a former company if given a salary equal to or higher than their current pay.

To top it off, roughly 30% of the labour force seems to liken the notion of quitting their job to pursue a full-time contracting career, which is an interesting idea given Canada’s economic uncertainty.

With inflation sitting at 6.9% along with rising interest rates, the cost of running a business in Canada has driven higher, meaning many businesses may not have the capital to increase salaries.

According to the latest Small Business Recovery Dashboard, 52% of small businesses in Canada have not returned to normal levels of revenue and 58% are still holding pandemic-related debt averaging over $114,000.

The Royal Bank of Canada published its Canadian Economic Outlook on December 14, stating that “the Canadian economy continues to inch closer to a recession in 2023.”

Headwinds from aggressive central bank interest rate hikes are gaining strength while unemployment has dropped to record lows (since 1976). With this in mind, RBC believes “the downturn will be ‘mild’ by historical standards.”

"While we don't know what the future holds as the labour market continues to evolve, prioritizing employee well-being, engagement and recognition will always be critical to attracting and retaining valued talent," added King.