Government Running Out Of Time To Collect Billions In Ineligible COVID Benefits

The federal government has a great deal of work to do to recover billions in overpayments from Covid-19 emergency benefit programs.

A report from Auditor General Karen Hogan released today concluded that the Canada Revenue Agency and Employment and Social Development Canada effectively delivered monetary relief to individuals and employers affected by the pandemic in order to stabilize the economy and help it rebound.

However, the report highlighted that the agency and department are not following through on the need to undertake post-payment verification work.

In 2020, because of a limited number of pre-payment controls, the government recognized that there was a risk some payments would go to ineligible recipients.

“We found that overpayments of $4.6 billion were made to ineligible individuals, and we estimated that at least $27.4 billion of payments to individuals and employers should be investigated further” Hogan stated in the House of Commons.

In fact, not only did these payments go to ineligible individuals and employers, Coastal Front found several instances of payments going to foreign corporations via the Canadian Emergency Wage Subsidy program.

Canadian Emergency Wage Subsidy (CEWS)

Foreign and state-owned corporations that received CEWS payments include:

Air China

China Southern Airlines

Royal Jordanian Airlines

United Airlines

The Walt Disney Company

Bank of China

Industrial Commercial Bank of China

Pertaining to CEWS, the auditor’s report found that 51,049 employers that received $9.87 billion did not demonstrate a sufficient revenue drop in order to be eligible for the subsidy.

A vast majority of CEWS payments did go to small to medium-sized Canadian businesses. (Source: oag-bvg.gc.ca).

It is worth noting that a majority of CEWS payments did end up in the hands of small to medium-sized Canadian businesses.

Because of an outdated system or instances of fraud, 3,724 employers representing $564 million received the subsidy while being registered as inactive or a closed business in the CRA’s system.

“The consequence of outdated account status information reduced the agency’s ability to efficiently deliver the [CEWS] program” the report states.

As of June 2022, 179 employers were impacted by unauthorized account access. Of these, $72 million in payments were prevented from being issued. A total of $39 million were paid in error and $60 million are currently under criminal investigation.

The report does not make reference to any instances of executive pay or compensation. In the application for CEWS, it sets forth that “any publicly listed corporation that decides to increase executive pay during this difficult time, while receiving taxpayer support, may have their wage subsidy funds clawed back.”

Canadian Emergency Response Benefit

The purpose of the Canada Emergency Response Benefit (CERB) was to support individuals who lost income as a result of the Covid-19 pandemic and to ensure they can meet their financial obligations.

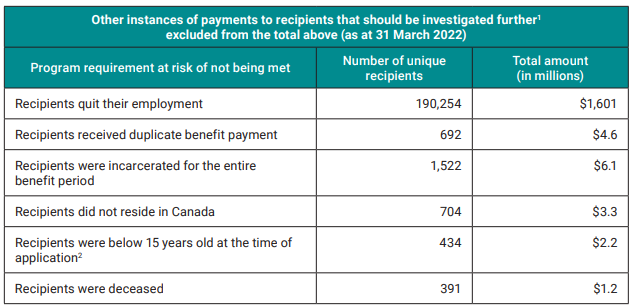

The report found recipients that should be investigated further, as recommended by the Auditor General. These include $6.1 million in payments to incarcerated individuals, $1.2 million to deceased individuals, $3.3 million to foreign persons and $4.6 million duplicate payments.

Other instances of CERB payments to recipients that should be investigated further as at 31 March 2022 (Source: oag-bvg.gc.ca)

To determine whether an individual was incarcerated, deceased or resided outside of Canada, the CRA simply matched the information on the person’s file after the payment had already been given.

The CRA’s post-payment verification plan primarily focused on CERB and began in January 2022. The agency identified 2.1 million cases where individuals had received more than $1,000 in employment or self-employment income during the benefit period, deeming them to be ineligible for CERB.

From the 2.1 million cases identified, the CRA contacted 104,000 recipients asking for additional information to confirm eligibility. Only 10.3% of those individuals provided a response as of May 2022.

As of July 2022, collection activities had not begun with respect to CERB payments.

Canada Recovery Benefit

The Canada Recovery Benefit succeeded the Canada Emergency Response Benefit and gave income support to employed and self-employed individuals who were directly affected by Covid-19 and were not entitled to employment insurance benefits.

The report found that as of July 2022, the CRA had yet to begin collection activities for its post-payment verification work. The agency reported that repayments of these benefits totaled $44.7 million but were unable to confirm the amounts from individuals for each of the Covid-19 benefit programs because of “a lack of detailed and disaggregated reporting data” the report explains.

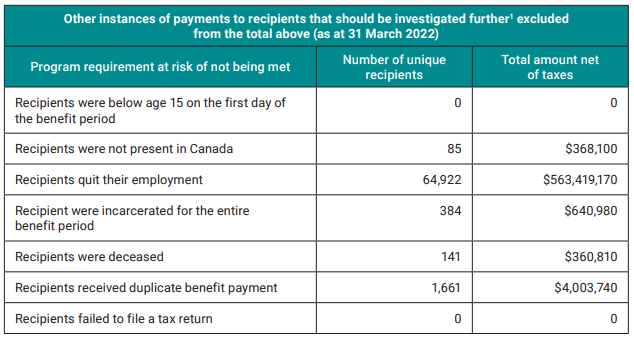

Recipients that should be investigated further, as recommended by the Auditor General’s report include $640,000 in payments to incarcerated individuals, $360,000 to deceased individuals, $370,000 to foreign persons and $4 million in duplicate payments.

Other instances of CRB payments to recipients that should be investigated further as at 31 March 2022 (Source: oag-bvg.gc.ca)

Running Out of Time?

As the pandemic evolved, the CRA and Employment and Social Development Canada delayed their plans for post-payment verifications. This means that the government may be running out of time to recover amounts because of legislated time frames to verify the recipient’s eligibility.

The time frame to verify a recipient’s eligibility for the payment is 36 months for most Covid-19 benefit programs for individuals.

Even if individuals tried or are trying to repay or make payment arrangements for amounts owed, the CRA is limited in responding to calls. Approximately, $2.3 billion in overpayments had been recovered through voluntary repayments as of the summer of 2022.

“I am concerned about the lack of rigour on post-payment verifications and collection activities,” said Ms. Hogan.

“The Canada Revenue Agency and Employment and Social Development Canada need to act now to expand their post-payment verification plans to include all recipients identified as being at risk of being ineligible for benefits.”

The Auditor General has offered the federal government a set of recommendations to improve the collection of overpayments and systems reporting.

Government organizations reviewed in the audit say they have accepted the recommendations.