Bank of Canada Reports First Loss, Result of Inflating Money Supply During Pandemic

For the first time in its 87-year history, the Bank of Canada has posted a comprehensive loss of $522 million in the third fiscal quarter.

The Bank has been seeing increases in interest expenses in all three quarters this year, with a sizable jump in the second quarter, specifically $842 million which resulted in only $281 million in income. This is a noticeable decrease when compared to $600 million in 2021 for the same quarter.

In its quarterly financial report, the Bank posted $1.467 billion in interest expenses, which is the primary reason for the Bank’s overall loss.

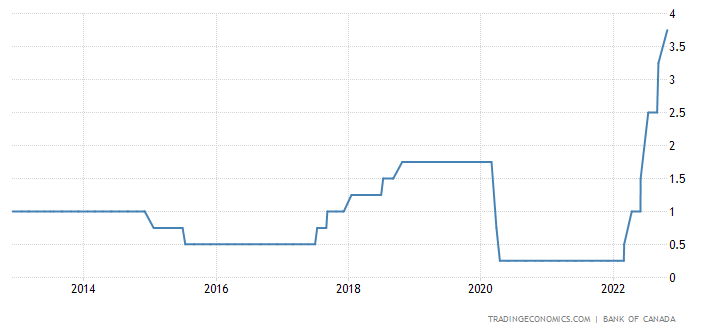

The cause for the loss is because of the drastic and frequent rises in the Bank’s policy interest rate in 2022. The Bank has raised interest rates six times this year and analysts expect another interest rate hike following the Bank’s Governor Tiff Macklem’s announcement on December 7.

Bank of Canada policy rate over the last 10 years (Source: tradingeconomics.com).

At the end of its report, the Bank suggests that the fourth quarter report may show similar results. “The impact of the pandemic on the Bank’s expenditures is expected to continue throughout the remainder of 2022.”

The Bank expanded its assets at a historic pace during the Covid-19 pandemic as part of its government bond purchasing program. As well, the Bank believed it needed to support the economy at the time by providing liquidity and maintaining a functioning market which ultimately led to quantitative easing.

Now, because of a variety of factors such as abnormally high inflation, the Bank is in the midst of quantitative tightening, which complements increases in the policy rate.

As a result, the Bank estimates it will lose between $5 billion and $6 billion in the next year or two, with hopes of returning to profitability in 2024 or 2025.

The Bank of Canada is not able to retain its earnings and does not have a reserve fund. Therefore, the Department of Finance needs to come up with a solution on how it will cover the Bank’s losses.

While the Bank continues to report losses on its quarterly reports, it will not run out of money, as there is no cap on the amount of liquidity it can provide. That being said, the losses will impact public finances as the Bank will not be able to send profits to the federal government.

The situation is a public relations nightmare, as the losses are a direct result of the central bank drastically expanding its assets during the Covid-19 pandemic.

Governor Macklem has defended the actions he took during the pandemic, but indicated last week that once the Bank’s main focus of returning inflation to its 2% target is accomplished, he will review all the actions taken during the pandemic.